The way in which the government traditionally spends the trillions of taxpayer dollars that it receives on an annual basis, to many Americans who are not directly involved in some finance or accounting based career, is somewhat of a mystery.

Though information on the subject is readily available, for the majority of the populace, especially youths attending school and the politically uninterested, the facts of the nations expenditures simply do not get around. The irony of this situation is the Internal Revenue Service, a bureau of the United States Department of the Treasury and primary organization associated with the collection of national tax, brings in an excess of 3 trillion taxpayer dollars per year, an extraordinarily large statistic by any definition.Though certainly known and discussed openly on large public news stations, rarely are the specifics of the United States budget presented bare for the public eye, the contents of which some might find surprising.

One important thing to remember regarding federal spending is the set divisions the government must partition the taxpayer money it has allocated into. These divisions fit into two main categories: mandatory and discretionary spending. About one third of the entirety of the federal budget goes into discretionary spending, which supports government programs such as the army, FBI, U.S. Coast Guard, and assorted highway projects. The other two thirds of the budget goes into mandatory spending as is defined by enacted federal laws, such as the funds necessary to support health care agencies, social security, programs that provide benefits to federal retirees and veterans, programs that provide benefits to disabled members of the military, veterans, or federal workers, and any other program mandated by law such as the Supplemental Nutrition Assistance Program or No Child Left Behind Act.

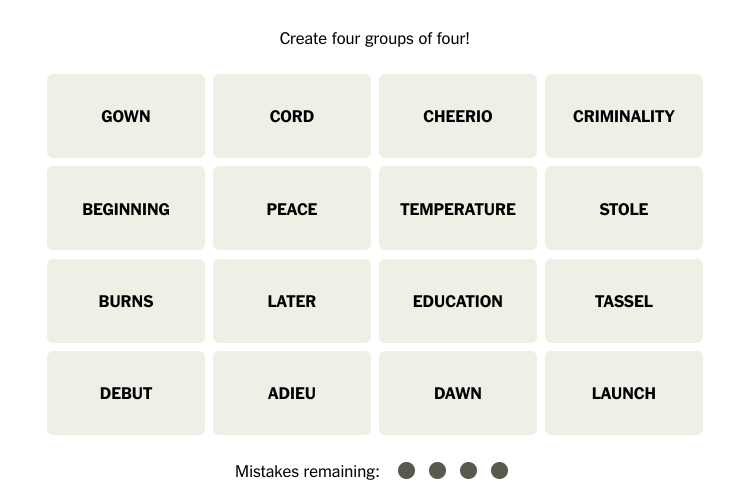

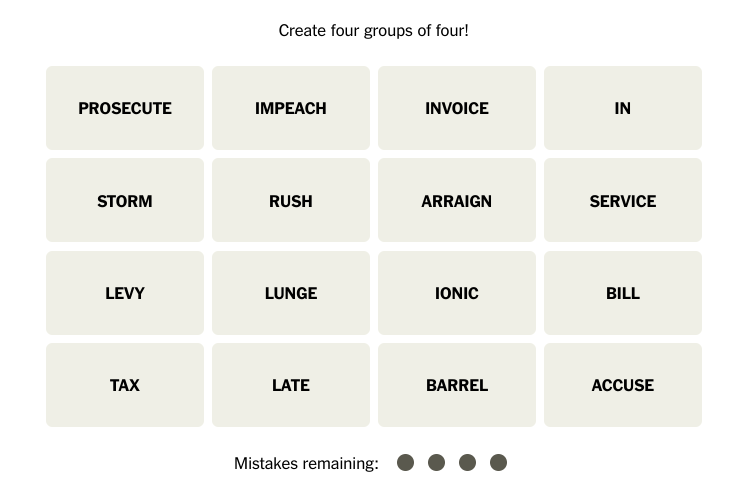

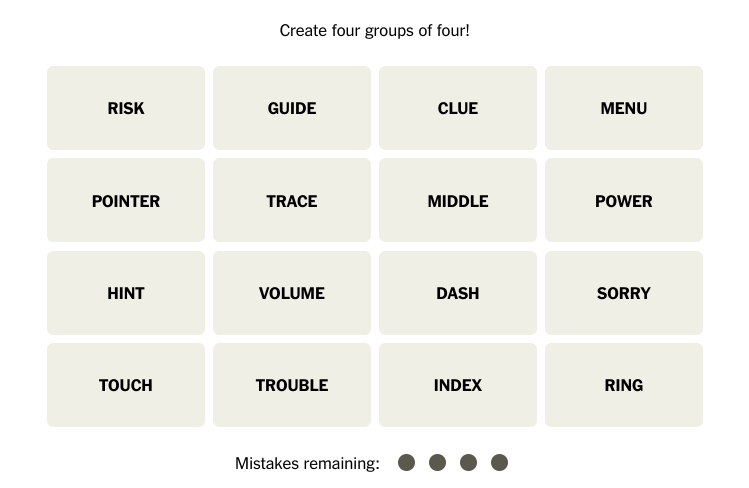

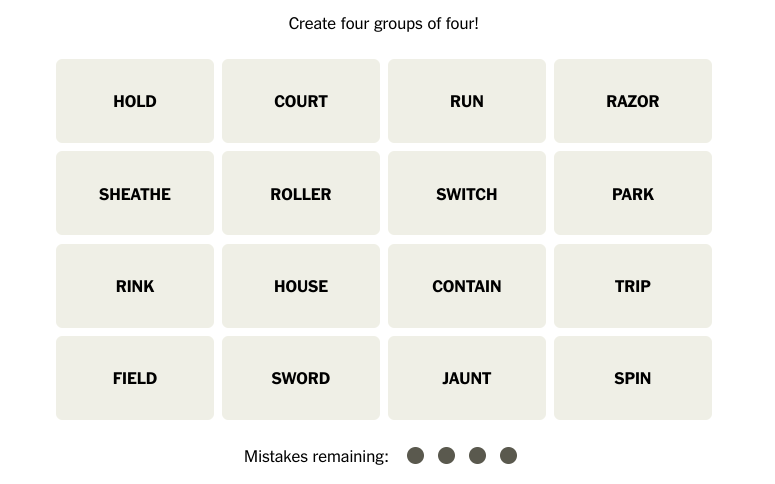

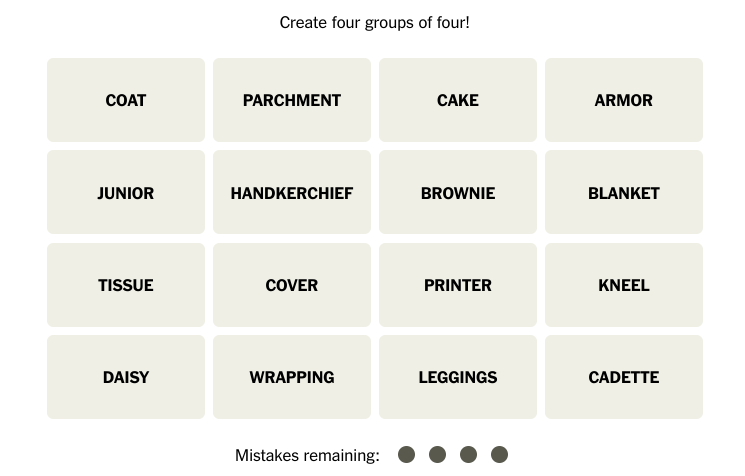

Included is a series of pie charts representing both mandatory and discretionary spending planned for the 2013 fiscal year separately and together, communicating visually how taxpayer money is usually divied up.

![Community honors longtime coach Mr. Bryan Thomas before Oct. 3 game [photo gallery]](https://nchsinkspot.com/wp-content/uploads/2025/10/Thomas-6-1200x1200.jpg)

![Week 7: Coach Drengwitz recaps the Ironmen’s win over Bloomington, talks Danville [video]](https://nchsinkspot.com/wp-content/uploads/2025/10/Vikings-feature-Image-1200x675.png)

![Halloween candy cross section quiz [quiz]](https://nchsinkspot.com/wp-content/uploads/2022/10/Candy-cover-big-900x675.png)

![Average Jonah? [quiz]](https://nchsinkspot.com/wp-content/uploads/2022/05/average-jonah-900x600.png)

![[Photo Illustration]](https://nchsinkspot.com/wp-content/uploads/2025/09/trigger-words.png)

![Week 5: Coach Drengwitz previews the Ironmen’s matchup vs. Peoria Manual, recaps Week 4 [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Week-5-v-Rams-1200x675.png)

![Postgame reaction: Coach Drengwitz on Community’s 28-17 Loss to Kankakee [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Week-4-postgame--1200x675.png)

![Week 4: Coach Drengwitz previews the Ironmen’s matchup vs. Kankakee [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Ironmen-v-Kankakee-video-1200x1200.png)

![On the Spot: This or That – Halloween [video]](https://nchsinkspot.com/wp-content/uploads/2024/10/tot-Halloween-YT-1200x675.png)

![On the Spot: This or That – Fall favorites [video]](https://nchsinkspot.com/wp-content/uploads/2024/10/ots-fall-web-1200x800.png)

![On the Spot – Teachers tested on 2023’s hottest words [video]](https://nchsinkspot.com/wp-content/uploads/2024/01/On-the-Spot-Teachers-tested-1200x675.png)