With over $52 million in facility repairs projected over the next five years, Unit 5 schools face mounting infrastructure needs—from roof replacements to outdated HVAC systems, according to Superintendent Dr. Kristen Weikle.

Normal Community alone accounts for nearly $18 million of those needs, the most of any Unit 5 school. Weikle said, every project on its list is classified as “red,” the district’s most urgent tier for repairs,

At Community, two boilers—which heat and circulate water or steam to regulate the building’s temperature—are nearing total failure, Weikle said; one already doesn’t work, and there are no replacement parts available.

Cooling towers at Community, West and Kingsley Junior High are similarly outdated. If one fails, she explained, classrooms may become uncomfortably hot or poorly ventilated during warmer months, as the HVAC system alone may not keep up without functioning cooling towers.

The track at Community also requires full reconstruction. Its deteriorating condition has made the facility ineligible to host IHSA events and raised safety concerns for both athletes and P.E. students, according to Weikle. A full rebuild is estimated to cost $6 million.

To address these needs, a proposed one-percent sales tax appears on the April 1 Consolidated Election ballot.

If passed, the tax would fund school facility upgrades, safety improvements, technology and mental health resources across all publicly funded schools in McLean County, according to Weikle.

“It’s one penny for every dollar spent on most purchases,” Weikle said. For example, a $5 coffee in McLean County would cost just five cents more.

Unlike property taxes, this sales tax would be shared by residents and visitors alike. An estimated 35% of the revenue would come from people who live outside McLean County—those attending Illinois State University and Illinois Wesleyan University, shopping locally or traveling in for events like IHSA state tournaments at Grossinger Motors Arena, Weikle said.

Property tax relief pledge

District officials estimate the tax could generate $28 to $29 million annually across McLean County, based on current consumer spending. Unit 5, the county’s largest district, would receive between $16 and $20 million of that total, Weikle said.

While some opponents worry the tax would burden residents—particularly low-income households—the proposed tax excludes essentials such as groceries and prescription medication, large purchases like vehicles and farm equipment, and personal services like haircuts or legal aid, Weikle said.

Something Unit 5 Education Association President Mrs. Julie Hagler confirmed.

“It doesn’t apply to what families need most,” Hagler said. “Groceries, prescriptions, medicine—those are exempt. That makes this tax far more equitable, even though it’s technically regressive.”

When you walk into Target, Hagler said, “anything in the grocery section or the medicine section is not taxed, but everything else…is taxed.”

Unit 5 has pledged to use a portion of the tax revenue to ease property tax burdens. In February, the school board passed a resolution committing one-third of the district’s revenue from the sales tax—around $5 million per year—for property tax relief for the next five years, Weikle said.

“This is not a blank check,” Weikle said. “This is a way to invest in our schools while relieving pressure on local property owners.”

Currently, Unit 5 receives only $1.5 million annually in property tax funding for health and life safety needs, a figure far short of what’s required to maintain infrastructure across 24 schools and additional district facilities, Weikle said.

Without the tax

Without the sales tax, Unit 5 will be forced to rely more heavily on borrowing through bonds to fund critical infrastructure projects. One set of bonds is already planned to cover necessary summer repairs, according to Weikle.

Those repairs can no longer wait—Hagler described multiple Unit 5 school roofs currently being held down by landscaping bricks.

Borrowing more would shift the financial burden entirely to property owners and add millions of dollars in interest payments. Hagler said the issue isn’t whether taxpayers will contribute—it’s how effectively their money will be used.

“The question is not whether taxpayers will pay,” Hagler said, “but whether their money goes directly to benefit kids in the classroom.”

If the district borrows the full $51 million needed for repairs, Hagler said the total cost could rise by approximately $10 million due to interest and fees—money that would never reach classrooms.

By contrast, she said, the one-cent sales tax offers a more fiscally responsible alternative. It allows the district to fund repairs directly, avoiding interest charges and expanding the pool of contributors to include out-of-county visitors.

In addition to funding facilities and student services, the tax could provide tax relief that extends beyond homeowners but also renters. “If we can provide relief to landlords,” Hagler said, “renters may feel that impact too.”

If the referendum fails, both Weikle and Hagler said, more portables, increased class sizes and further delays in essential repairs are likely. Even renters, Weikle said, may feel the ripple effects if landlords raise rent to absorb higher property taxes.

Regional precedent, countywide benefit

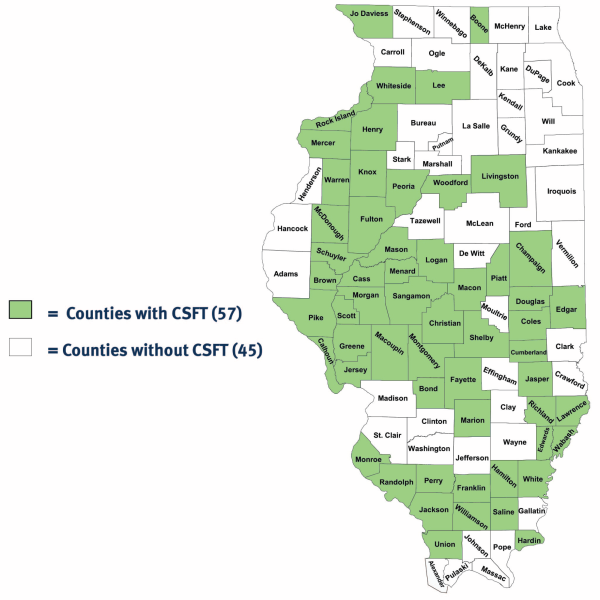

McLean County is one of the few in Central Illinois without a school sales tax, according to Weikle.

Majority of surrounding counties like Peoria, Champaign and Sangamon have already adopted the measure. When McLean County residents shop in those areas, they support other school districts—but when visitors spend money in McLean, no tax goes toward local education.

“People come to town, they eat, they buy fuel, they shop,” Weikle said. “If this tax were in place, we would finally benefit from that activity.

Weikle noted that rural districts would also benefit. Many of these smaller districts rely heavily on property taxes and lack the reserve funding to cover major repairs like roof replacements. In some cases, she said, their needs may be even more urgent than Unit 5’s.

Looking forward

The tax cannot be used for salaries, but it can fund infrastructure and student support services. Legislation passed since 2014 expanded the original purpose of the school sales tax to include school safety and mental health resources, Weikle said.

Unit 5 could use the funds to install building-wide crisis alert systems—devices that allow teachers to call 911 from their lanyard badge—and to increase access to social workers and psychologists. The district could also use the money to increase stipends for interns in school psychology or social work, improving recruitment and retention, Weikle said.

Additional school counselors—especially at the elementary level—could be hired with this funding, Weikle said. Currently, most counselors serve only junior highs and high schools, though a few are grant-funded at elementary schools.

“We’re being asked to do more for students than ever before,” Hagler said. “But we can’t do it without funding.”

In the long term, the district hopes to “reimagine” school facilities beyond basic repairs. That includes modernizing classrooms, libraries, science labs and fine arts spaces, according to Weikle.

“Many of our buildings were built 30 to 50 years ago,” Weikle said. “They weren’t designed for the needs of today’s students.”

According to Weikle, Community’s principal Dr. Adam Zbrozek has proposed redesigning Community’s library into a more flexible and collaborative space—just one example of a project the tax could fund in later years to “better meet the needs of today’s students and staff.”

Weikle said that while the district would prioritize urgent infrastructure repairs in the first few years, design planning for classroom modernization could begin immediately.

Hosting more IHSA events is another long-term benefit. With improvements to athletic facilities like tracks and pools, Unit 5 schools could welcome more tournaments and competitions—bringing in revenue and offering student-athletes opportunities to compete at home.

Enhanced school safety. Additional mental health support. Modernized classrooms. Relieved property taxes.

For supporters, the possibilities are clear. On April 1, voters will decide whether to approve the funding mechanism that could make those improvements possible.

As a public school district, Unit 5 is legally prohibited from campaigning for or against the referendum—but it can provide facts about the measure and its potential impact.

“We can’t tell people how to vote,” Weikle said. “We can only ask that they make an informed decision.”

To help voters understand the proposal, Unit 5 hosted a series of public informational meetings and posted nonpartisan materials online at www.april1cent.info.

Three emails sent to the McLean County Republican Party requesting comment on its opposition to the measure—outlined on their website, urging voters to vote no—were not returned.

![Community honors longtime coach Mr. Bryan Thomas before Oct. 3 game [photo gallery]](https://nchsinkspot.com/wp-content/uploads/2025/10/Thomas-6-1200x1200.jpg)

![Week 7: Coach Drengwitz recaps the Ironmen’s win over Bloomington, talks Danville [video]](https://nchsinkspot.com/wp-content/uploads/2025/10/Vikings-feature-Image-1200x675.png)

![Halloween candy cross section quiz [quiz]](https://nchsinkspot.com/wp-content/uploads/2022/10/Candy-cover-big-900x675.png)

![Average Jonah? [quiz]](https://nchsinkspot.com/wp-content/uploads/2022/05/average-jonah-900x600.png)

![[Photo Illustration]](https://nchsinkspot.com/wp-content/uploads/2025/09/trigger-words.png)

![Week 5: Coach Drengwitz previews the Ironmen’s matchup vs. Peoria Manual, recaps Week 4 [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Week-5-v-Rams-1200x675.png)

![Postgame reaction: Coach Drengwitz on Community’s 28-17 Loss to Kankakee [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Week-4-postgame--1200x675.png)

![Week 4: Coach Drengwitz previews the Ironmen’s matchup vs. Kankakee [video]](https://nchsinkspot.com/wp-content/uploads/2025/09/Ironmen-v-Kankakee-video-1200x1200.png)

![On the Spot: This or That – Halloween [video]](https://nchsinkspot.com/wp-content/uploads/2024/10/tot-Halloween-YT-1200x675.png)

![On the Spot: This or That – Fall favorites [video]](https://nchsinkspot.com/wp-content/uploads/2024/10/ots-fall-web-1200x800.png)

![On the Spot – Teachers tested on 2023’s hottest words [video]](https://nchsinkspot.com/wp-content/uploads/2024/01/On-the-Spot-Teachers-tested-1200x675.png)